All Categories

Featured

Table of Contents

The primary distinctions in between a term life insurance coverage policy and a long-term insurance coverage (such as whole life or universal life insurance coverage) are the period of the plan, the accumulation of a money worth, and the price. The ideal selection for you will depend upon your demands. Below are some things to consider.

Individuals who have whole life insurance policy pay more in premiums for much less protection yet have the protection of knowing they are safeguarded permanently. Level term life insurance benefits. People that buy term life pay costs for an extended duration, however they get absolutely nothing in return unless they have the misfortune to die prior to the term ends

The performance of long-term insurance can be steady and it is tax-advantaged, giving extra benefits when the supply market is unstable. There is no one-size-fits-all answer to the term versus permanent insurance debate.

The rider ensures the right to convert an in-force term policyor one ready to expireto an irreversible plan without going through underwriting or verifying insurability. The conversion rider need to permit you to transform to any kind of permanent plan the insurer supplies without limitations. The primary features of the rider are preserving the original health ranking of the term policy upon conversion (also if you later on have wellness concerns or become uninsurable) and making a decision when and just how much of the insurance coverage to convert.

How do I cancel Level Term Life Insurance Premiums?

Of training course, total costs will certainly boost substantially since whole life insurance is extra costly than term life insurance - Level death benefit term life insurance. Clinical problems that develop during the term life period can not create costs to be raised.

Entire life insurance coverage comes with significantly greater month-to-month premiums. It is meant to offer protection for as lengthy as you live.

Insurance coverage business set an optimum age limit for term life insurance coverage policies. The costs also rises with age, so an individual aged 60 or 70 will certainly pay significantly even more than someone decades more youthful.

Term life is somewhat similar to cars and truck insurance policy. It's statistically unlikely that you'll need it, and the costs are money down the drain if you do not. If the worst takes place, your family will receive the advantages.

Is there a budget-friendly Level Term Life Insurance Vs Whole Life option?

___ Aon Insurance Policy Services is the brand name for the brokerage and program management procedures of Affinity Insurance coverage Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Company, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Policy Services Inc.; in CA, Aon Fondness Insurance Policy Solutions, Inc.

The Plan Agent of the AICPA Insurance Trust Fund, Aon Insurance Policy Services, is not associated with Prudential. Team Insurance policy protection is released by The Prudential Insurance Policy Company of America, a Prudential Financial company, Newark, NJ.

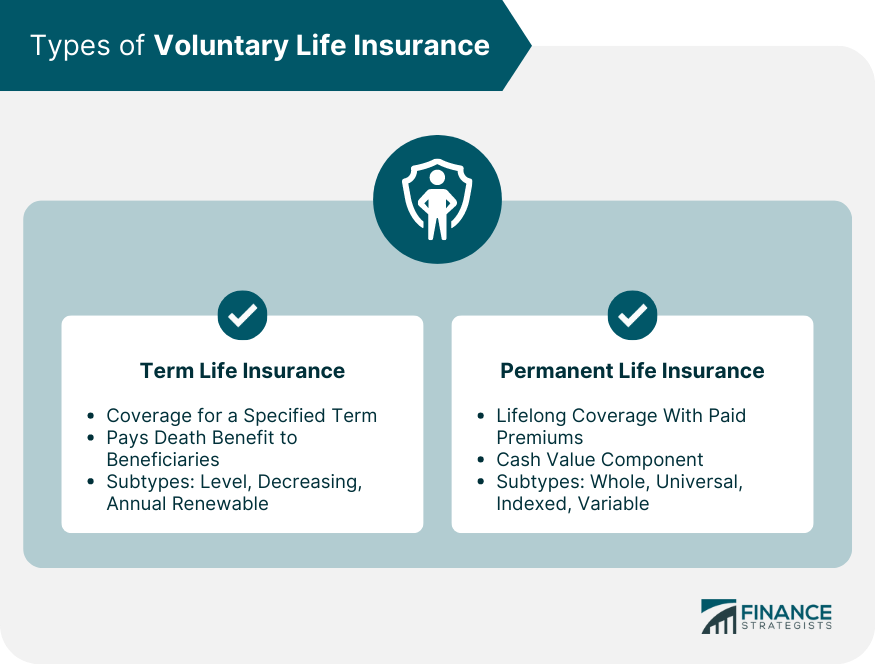

Generally, there are two kinds of life insurance policy intends - either term or permanent strategies or some mix of the two. Life insurance providers supply numerous types of term strategies and conventional life policies as well as "rate of interest sensitive" items which have become a lot more prevalent since the 1980's.

Term insurance policy gives defense for a specified amount of time - Best value level term life insurance. This duration might be as short as one year or provide protection for a certain variety of years such as 5, 10, two decades or to a defined age such as 80 or in some instances as much as the earliest age in the life insurance coverage mortality

What happens if I don’t have Level Term Life Insurance?

Currently term insurance rates are very competitive and among the most affordable traditionally knowledgeable. It should be kept in mind that it is an extensively held belief that term insurance policy is the least expensive pure life insurance policy coverage readily available. One needs to review the plan terms meticulously to make a decision which term life choices are ideal to meet your specific conditions.

With each new term the costs is boosted. The right to renew the policy without proof of insurability is a crucial benefit to you. Otherwise, the danger you take is that your wellness may wear away and you might be incapable to get a policy at the exact same prices or perhaps in any way, leaving you and your recipients without insurance coverage.

The length of the conversion period will differ depending on the type of term plan bought. The premium price you pay on conversion is generally based on your "existing obtained age", which is your age on the conversion date.

Level Term Life Insurance Policy

Under a level term policy the face amount of the plan stays the exact same for the whole duration. Usually such policies are sold as home loan protection with the quantity of insurance lowering as the balance of the home mortgage lowers.

Traditionally, insurers have actually not deserved to alter premiums after the plan is offered. Since such plans might proceed for several years, insurance firms have to utilize traditional mortality, interest and expenditure price quotes in the costs computation. Flexible costs insurance coverage, nonetheless, enables insurance firms to supply insurance at reduced "current" costs based upon much less traditional assumptions with the right to transform these costs in the future.

While term insurance is developed to offer defense for a specified period, permanent insurance policy is made to offer coverage for your whole lifetime. To keep the premium rate degree, the costs at the more youthful ages goes beyond the actual cost of defense. This additional costs develops a book (cash value) which aids pay for the policy in later years as the expense of defense increases over the premium.

Why do I need Affordable Level Term Life Insurance?

With level term insurance policy, the expense of the insurance coverage will certainly remain the same (or potentially lower if dividends are paid) over the term of your policy, usually 10 or twenty years. Unlike irreversible life insurance policy, which never runs out as lengthy as you pay costs, a degree term life insurance plan will certainly finish eventually in the future, typically at the end of the duration of your degree term.

Due to this, many individuals utilize irreversible insurance policy as a steady economic planning device that can offer lots of demands. You may have the ability to transform some, or all, of your term insurance policy during a collection period, typically the very first ten years of your policy, without needing to re-qualify for protection even if your health has changed.

How do I choose the right Tax Benefits Of Level Term Life Insurance?

As it does, you might desire to add to your insurance protection in the future. As this occurs, you might desire to eventually decrease your death benefit or consider transforming your term insurance policy to an irreversible plan.

As long as you pay your premiums, you can rest very easy recognizing that your enjoyed ones will certainly receive a death advantage if you pass away throughout the term. Many term plans enable you the capacity to transform to irreversible insurance without needing to take an additional wellness test. This can allow you to take advantage of the fringe benefits of a long-term policy.

Latest Posts

Life Insurance Burial

Seniors Funeral Insurance Reviews

Burial Insurance Companies